The Monetary Policy Council’s decision on Tuesday to raise rates again was expected, and in fact the only doubt was its size. It turns out that the MPC raised the NBP reference rate by 0.50 percentage points to 2.25%. This is the highest level since 2014.

A rate hike is of course a necessary component of fighting inflation and a plan to bring it down to the NBP inflation target (ie 2.5% with possible fluctuations of 1 pip up or down) in the medium term. According to the head of the National Bank of Poland, Adam Glapinski, this should happen in the last quarter of 2023. Usually in the second half of 2023, when annual inflation drops to at least 3.5%, other economists say.

- Read more about housing loans at Gazeta.pl

Borrowers will pay more

But this fight against inflation means loss of life. Goes, among others o people who repay housing loans in zlotys (foreign currency has not been given for nearly a decade).

The increase in premiums due to higher interest rates should not, in principle, surprise or shock anyone. Borrowers understand (or at least should be) that this is how contracts are structured. As a rule, banks are also obliged to remind about the risk of interest rates when obtaining a loan. But it is known that one of the advisers in the bank did this more reliably, while others only gave another signature sheet without a word of explanation.

However, it is something to be warned about the dangers of foot and another to try. Subsequent messages from the bank about the new installment amount can be stressful and traumatic for many.

Interest rates are rising in Poland for the first time since May 2012. A decade ago, interest rates fell or remained flat. From the end of May 2020 to the beginning of October 2021, the key rate was close to zero – only 0.10 percent.

It can be said that even half a generation and hundreds of thousands of zloty borrowers did not know at all what the increase in the premium meant (unless it was a symbol, for example, if WIBOR increased several hundred percent). Regardless of which person took a loan in PLN in 2012 or later, the premiums have only decreased. Who took out a loan in 2020 and 2021, the premium could not be lower.

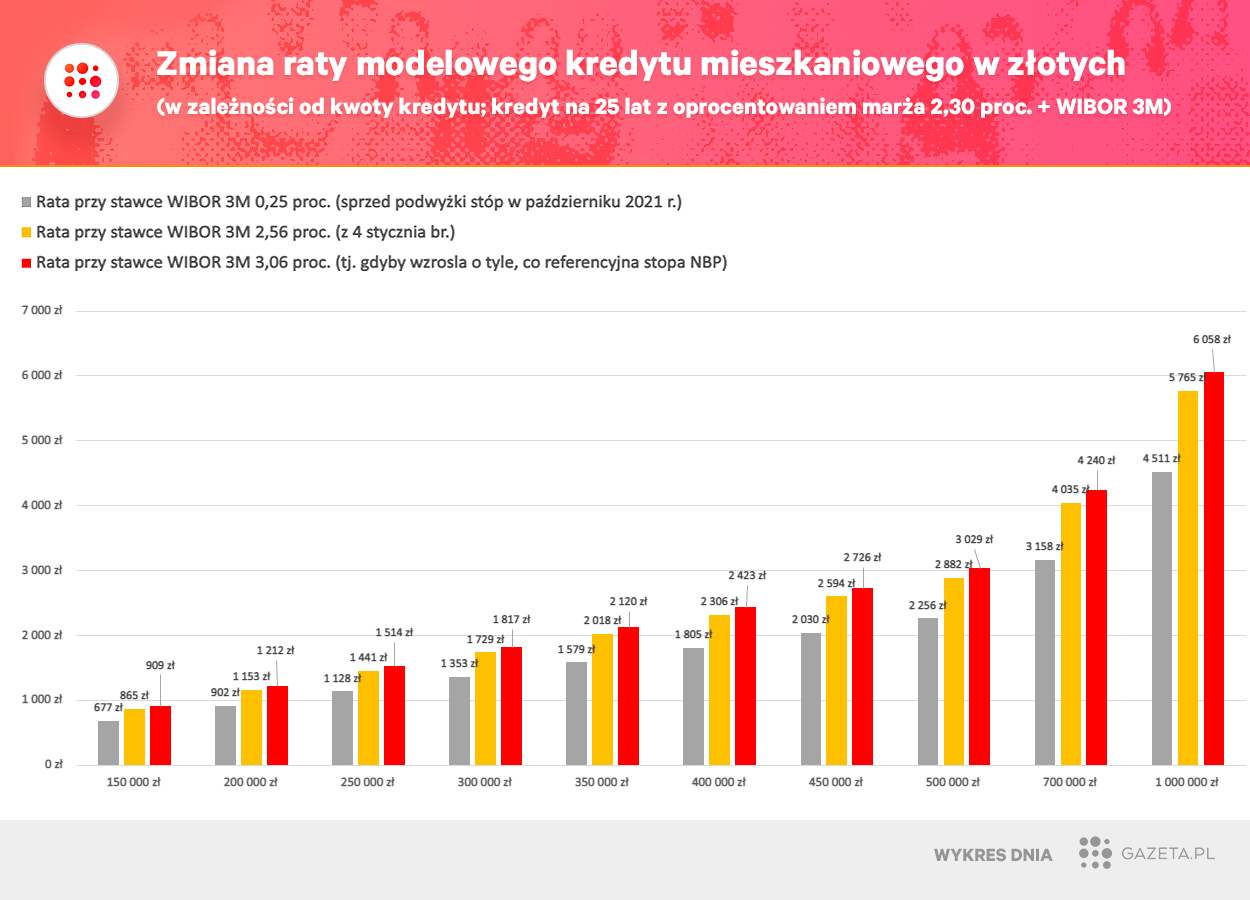

Now this is painfully changing. In October, a sample loan installment of 200 thousand. The 25-year PLN (with a margin of 2.30%) was about PLN 902. At the current WIBOR 3M rate (2.56%), it is already over PLN 1,150. If – hypothetically – WIBOR soon increases by the NBP reference rate after the January increase (ie by 0.50 p) – then the premium will jump by about another PLN 60.

This is a version for people who have borrowed a fairly low amount. If a person took a loan on the same terms but in the amount of 500,000 PLN, the premium jumped in the past by more than 600 PLN (from about 2,256 PLN to about 2,882 PLN), and another increase in the WIBOR rate by 0.50 p. It may mean an increase in the premium to more than 3000 zlotys.

It shouldn’t be a problem yet, but it’s a shock – sure

According to a recent survey PAP Biznes Among bankers, an increase in interest rates to a level of about 4 per cent that Poles should instead take off. The problem may be for some with higher rates. Dr. Jakob Saulsky, head of the macroeconomics team at the Polish Economic Institute, has a similar view.

For some people, higher loan installments may cause repayment problems, but I don’t see a disaster here. Interest rates are around 3%. This will remain a moderate level and should not fundamentally change the situation

– Dr. Sawulski said in an interview with Gazeta.pl. He emphasized that “people with mortgages are not the poorest class in Polish society.”

People who have a mortgage are rather people who should be able to pay a premium of up to PLN 500 above the standard low rates. A family of four, where the parents have an income close to minimum wage, do not have a mortgage because they are not creditworthy

– The expert indicated.

Poles repay more than 2 million zlotys

According to data from the Credit Information Bureau, Poles currently repay more than 2.1 million housing loans in PLN. Most importantly, the vast majority of them have been granted in recent years, already at low interest rates. From the beginning of 2015 to October 2021 inclusive, banks awarded more than PLN 1.5 million, with a total value of nearly PLN 400 billion.

Only in the first 10 months of 2021, more than 250,000 applications were granted in Poland. PLN currency loans. That’s more than in the record-breaking 2019 so far (down from 240,000 at the time). And you have to remember that the vast majority of 2021 was close to zero interest rates, and therefore really low premiums, “tempting” to borrow really large sums.

The average loan amount granted has grown significantly in recent years. In 2021, the number was approximately 334 thousand. PLN, while in 2019 it was more than 50 thousand. less (about 273 thousand PLN) and in 2015 by about 120 PLN less (about 204 thousand PLN). People who took advantage of very low interest rates and had to borrow using credit to the fullest, will now have to tighten their belts in particular.

This is especially true for residents of Warsaw – in 2021, more than half of the money borrowed by banks under housing loans poured into them.

“Problem solver. Proud twitter specialist. Travel aficionado. Introvert. Coffee trailblazer. Professional zombie ninja. Extreme gamer.”

![Another higher rate = higher premiums. This was not the case nearly a decade ago [WYKRES DNIA] Another higher rate = higher premiums. This was not the case nearly a decade ago [WYKRES DNIA]](https://nextvame.com/wp-content/uploads/2022/01/Another-higher-rate-higher-premiums-This-was-not-the-1024x576.jpg)

.jpeg)

.jpeg)

.jpeg)

More Stories

Below is the schedule of pension payments as of July 2022. Find out what benefits you will get after the changes [17.07.2022]

Overview of the new electric sports cars for the Hyundai Ioniq 5 N and Ioniq 6 N

Portugal has launched a floating solar power plant. It is the largest structure of this type in Europe – Economy