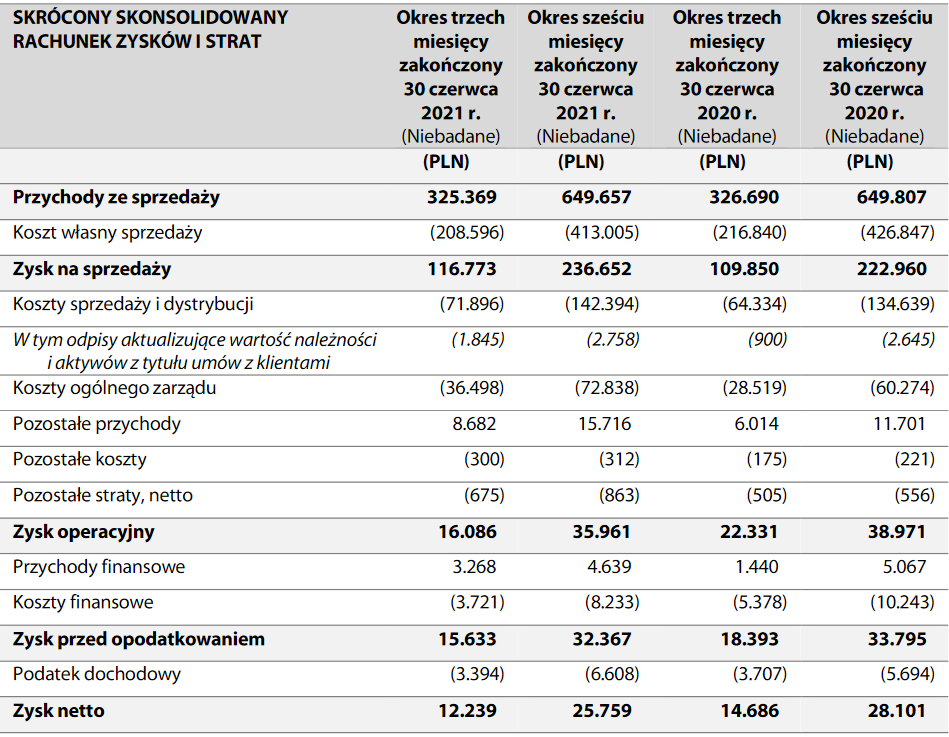

Netia’s EBITDA fell in the second quarter of 2021 to PLN 111.3 million from PLN 116.1 million a year earlier, the company announced in its semi-annual report. Netia’s net profit decreased to PLN 12.2 million from PLN 14.7 million in the previous year.

Netia’s EBITDA in the first half of the year amounted to PLN 223.5 million and was at a similar level to that of the previous year.

The company’s net profit in the first half of 2021 decreased to PLN 25.8 million, compared to PLN 28.1 million last year.

67 percent of Netia services are in its own network

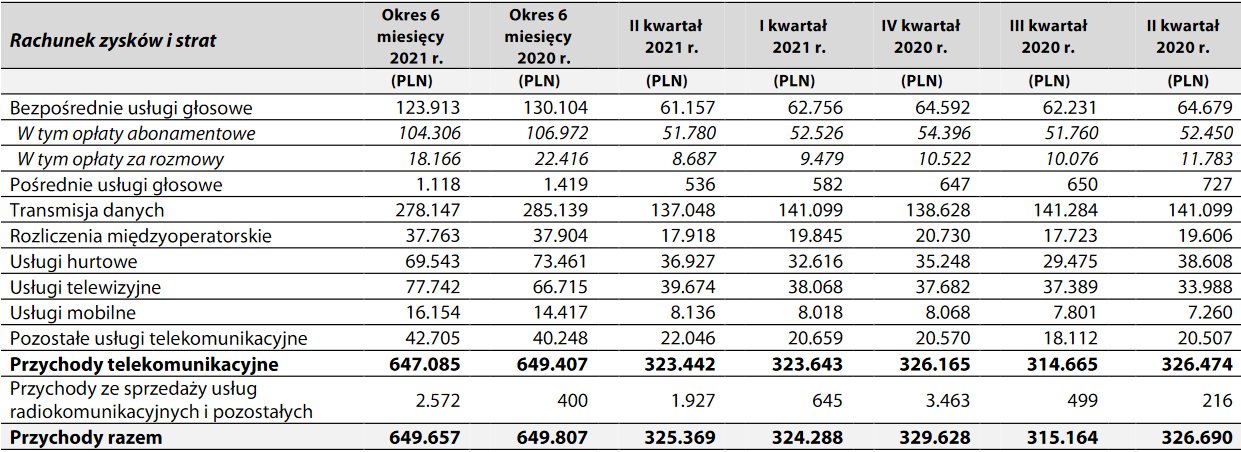

Netia Group’s revenue in the second quarter amounted to PLN 325.4 million (PLN 326.7 million in the previous year), and in the entire first half of the year amounted to PLN 649.7 million, compared to PLN 649.8 million a year earlier.

The share of services provided in its own network increased from 67%. On June 30, 2020 to 69 percent on June 30, 2021

In the last quarter, revenue from direct voice services decreased year on year from 64.68 PLN to 61.16 million PLN, from data transmission – from 141.1 PLN to 137.05 million PLN, from wholesale services – from 38.61 to 36.93 million PLN. On the other hand, revenue from television services increased from PLN 33.99 to PLN 39.67 million, and from mobile services – from PLN 7.26 to PLN 8.14 million.

Less on investment

Netia’s capital expenditures in the second quarter were PLN 85.6 million, compared to PLN 84.7 million last year. Since the beginning of 2021, the company’s capital expenditure has decreased to PLN 165.6 million from PLN 178.4 million in the first half of 2020.

Cash and short-term deposits reported by Netia Group on June 30, 2021 amounted to PLN 37.4 million compared to PLN 24.2 million on June 30, 2020 (55% per annum).

The debt with accrued interest, calculated on the basis of the value of loans and borrowings as on June 30, 2021, amounted to 335 million PLN (the same as the previous year).

Net debt, calculated on the basis of the value of loans, borrowings and lease obligations, less cash and short-term deposits, as at June 30, 2021, was PLN 588.6 million, compared to PLN 574.7 on June 30, 2020. (2 percent y/h).

At the end of July, Cyfrowy Polsat announced a compulsory purchase from minority shareholders of all Netia shares at 7 PLN per share. Since then, the company’s shares are no longer listed on the Warsaw Stock Exchange.

“Problem solver. Proud twitter specialist. Travel aficionado. Introvert. Coffee trailblazer. Professional zombie ninja. Extreme gamer.”

More Stories

Below is the schedule of pension payments as of July 2022. Find out what benefits you will get after the changes [17.07.2022]

Overview of the new electric sports cars for the Hyundai Ioniq 5 N and Ioniq 6 N

Portugal has launched a floating solar power plant. It is the largest structure of this type in Europe – Economy